When recommending LTC insurance for your clients, "default" benefits can often make the job of selecting plan options easier, but is that what is best for your client in every situation? For example, the vast majority of LTCI buyers select a 90 day period before benefits start paying. This option tends to work well as both a reasonable deductible and could coordinate with how Medicare pays LTC benefits.

Another option that dominates both traditional and linked Life/LTC sales is the 3% compound benefit increase option. Of course, buyers like some form of inflation protection to keep pace with future cost of care increases, especially for younger buyers. However, there may be reasons to consider different alternatives to 3% compound in certain circumstances.

First a little background. The passage of HIPAA in 1996 included several provisions related to LTC Insurance, including a requirement that applicants be offered a 5% compound inflation option (even though the inflation rate in 1996 was 3%.)

That decision to mandate an option was unfortunate because many of the polices that included an automatic 5% compound inflation option ended up performing poorly for insurance carriers and led to requests of in-force rate increases. As someone who personally owns a 5% compound inflation policy, I found that my benefit increased so dramatically compared to the actual cost of care that I could defray some of the in-force premium notices on my and my wife's personal policies by simply adjusting my daily benefit down to a level more approximate with the actual cost of care. Several carriers are managing in-force rate increases by giving policyholders an option to maintain current premium levels, while lowering future inflation increases.

As companies realized their pricing challenges, they responded a couple of ways. First, they introduced pricing on 5% compound policies that was so high it discouraged sales (even though the plans, by regulation, still had to offer this to consumers.) Secondarily, they started offering new inflation options - and the one that because most popular was 3% compound automatic inflation increase.

3% compound coverage, although dramatically less expensive for carriers than 5% compound, still doubles possible benefits every 25 years and is an expensive policy rider. In order offer lower premium products, companies have created some alternatives to 3% compound coverage. Understanding these options can help an advisor provide better guidance for LTC protection - while keeping premiums affordable. Below is a list of some options- with examples of how premiums and future benefits are impacted. (All examples are based on the premiums for a married female.)

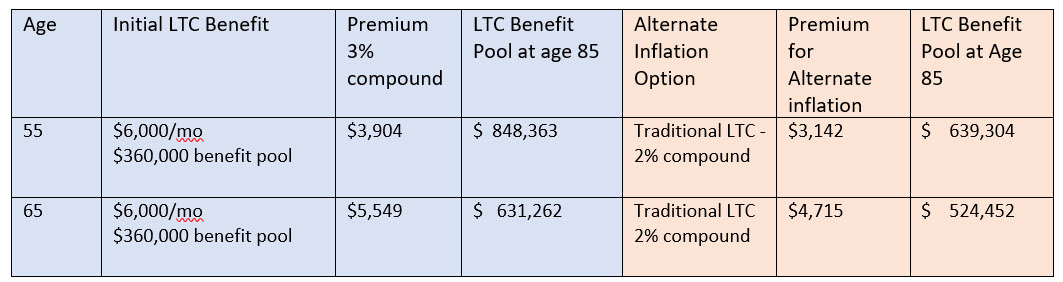

Option 1: Lowering the inflation percentage: One cost saving option is to simply lower the automatic inflation adjustment from 3% compound to a lower percentage. Some carriers offer as low as a 1% inflation increase. Depending on the state, these plans still qualify for LTC Partnership protection. In the example below, we look at the impact of a 55 year old buyer and a 65 year old buyer who are considering a traditional LTC plan. In both examples clients can save some significant premium dropping to a lower rate, yet may be able to afford a higher initial monthly benefit. In this approach, it can be helpful when you know your client's budget, and you can adjust the inflation rate to meet their budget.

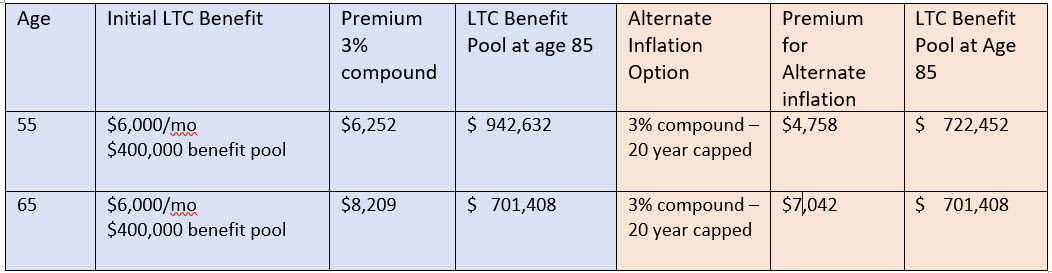

Option 2: Limit the number of years of increase: Some plans will increase at a compound rate but limit the years of increased inflation. For example, one carrier offers plans that only inflate for 10, 15, or 20 years.

In the example below with a linked life/ltc plan you can see the impact of capping inflation for 20 years. For younger buyers at age 55, it may make sense to keep the "uncapped" inflation benefit, lower the initial benefit amount, and let the magic of compound interest do its work. For the 65 year old buyer, however, the premium savings may mean the capped benefit is more appropriate. Note - the cash value increases for a younger buyer with linked life/ltc plans, money of which is available for LTC benefits.

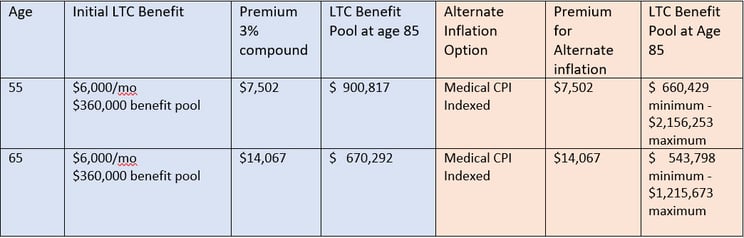

Option 3: Medical CPI Increase: One linked life/ltc carrier offers a plan that increases benefits based on the Medical CPI increase amount. The plan has a floor of zero % increase with annual maximum cap of a 6% increase. An alternate calculation ensures that the policyholder will get at least a 2% compound adjustment.

In the example below, clients and advisors who are concerned about high medical inflation can purchase the rider for the same premium as 3% compound - with a high upside against inflation.

In addition to these options, here are a couple of other inflation alternatives that have been used on products:

Step Rated: A step-rated option will increase benefits at a selected amount, say 3% compound for life - but also increase premiums at a 3% compound or ever increasing rate. Some plans will offer a freeze of both premium increases and benefit increases. This will allow someone to purchase a plan at a lower initial cost, but have some control over how their benefits and premium grows.

Simple Inflation Coverage: Simple inflation only inflates on the original benefit level on not attained. Some life/ltc carriers offer simple inflation coverage, typically increasing 3% or 5% simple. Often a 5% simple inflation option works similar to a 3% compound for someone 20-25 years away from needing care.

What now? Next time you are reviewing illustrations, consider alternative inflation protection options when you need to hit a target premium for your client. Most illustrations include charts to show how the benefits will grow, and you can really see the power of your inflation protection option for the typical claim age. In most cases 3% compound inflation protection will still be appropriate - but we also appreciate the choices and innovation in LTC Insurance.

Written by Tom Riekse Jr

Tom Riekse, Jr., ChFC, CLU, CEBS is the Managing Director of LTCI Partners. He has been working in the long-term care insurance business since 1991 with an emphasis on communicating the value of LTC planning to advisors, employers and consumers. He has primary responsibility for all marketing and technology initiatives at LTCI Partners, and has worked closely with carriers and vendors to make LTC Insurance easier to sell and enroll. Tom received his undergraduate degree in from Hope College, Holland Michigan. He subsequently achieved his MBA at the University of Illinois at Chicago, with a concentration in finance and marketing. He holds the Certified Employee Benefit Specialist designation from the International Foundation of Employee Benefit Plans and the Wharton School and his Chartered Financial Consultant from the American College.

-CMYK.png?width=200&name=LifeSecureLogo(F)-CMYK.png)

%20.png?width=148&height=55&name=b.%20RSSA_Logo_(R)%20.png)