NAIFA's Limited & Extended Care Planning Center hosted "Don't Be Scared of Long-Term Care," on Monday, October 31 to help kick off Long-Term Care Awareness Month. If you missed any of the sessions that day, or want to revisit particular talks, recordings of all eight presentations are now available to watch on-demand.

1 min read

LECP's Impact Day 2022 Now Available On-Demand

By NAIFA on 11/11/22 11:55 AM

Topics: Long-Term Care Webinar Limited & Extended Care Planning Center Insurance

1 min read

Long-Term Care Crisis ‘Sneaking Up on Most Americans’

By NAIFA on 11/3/22 9:54 AM

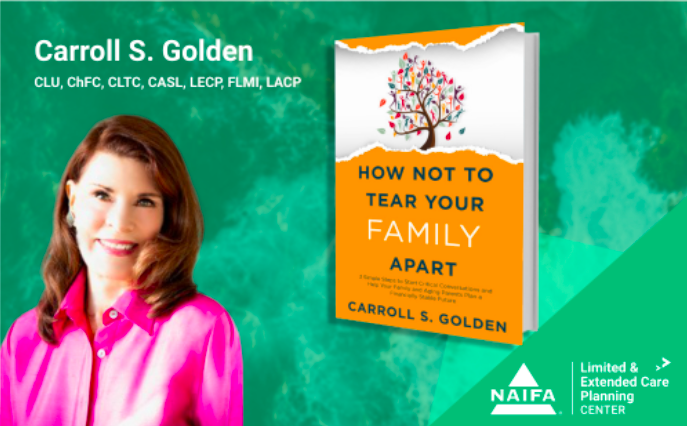

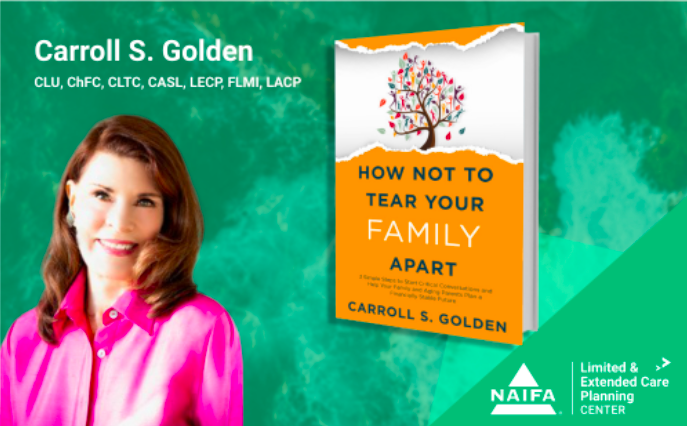

On Monday, October 31's "Don't Be Scared of Long-Term Care," NAIFA's Executive Director of Centers of Excellence, Carroll Golden, addressed the crisis of long-term care that is sneaking up on most Americans. "When we look at the cost of care, it’s only increasing and it’s increasing dramatically," she said at the Limited & Extended Care Planning Center's annual Impact Day.

Topics: Long-Term Care Limited & Extended Care Planning Center

1 min read

Tackle the Scariest Topics in Long-Term Care at LTC Impact Day 2022

By NAIFA on 10/19/22 11:32 AM

We're kicking off November's Long-Term Care Awareness Month on Halloween, Monday, October 31 to get the message out that you don't need to be scared of long-term care conversations!

NAIFA's Limited & Extended Care Planning (LECP) Center is hosting "Don't Be Scared of Long-Term Care," a free, day-long virtual program from 9 am to 5 pm. Included are interactive sessions from industry leaders who will address the scariest of topics in the long-term care arena.

Topics: Long-Term Care Webinar Limited & Extended Care Planning Center Insurance

2 min read

These Two Trends Signal Much Higher LTC Costs in the Future - Regardless of Inflation

By Tom Riekse Jr. on 8/24/22 3:19 PM

Topics: Long-Term Care Research/Trends Long-Term Care Insurance Limited & Extended Care Planning Center

1 min read

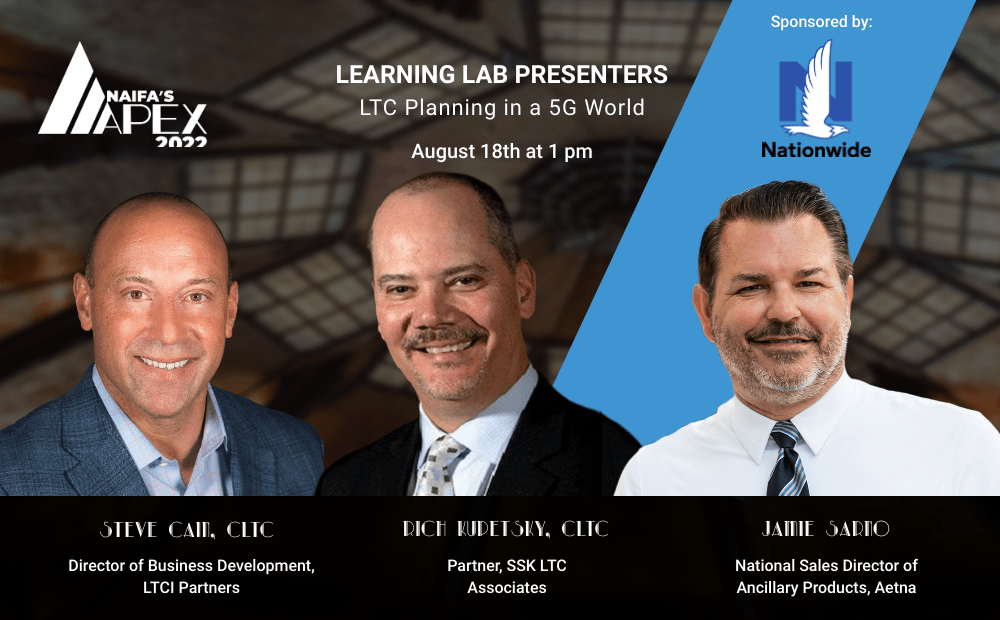

Experts at Apex will Explore Technology’s Transformation of the LECP Marketplace

By NAIFA on 8/8/22 9:15 AM

The limited and extended care planning (LECP) marketplace is transforming apace with innovations in technology. The rise of 5G, the fifth-generation standard for broadband cellular networks, has revolutionized the way we handle LECP data, providing greater data speeds, more reliability, and massive network capacity.

Topics: Long-Term Care Limited & Extended Care Planning Center Apex

3 min read

NAIFA's Limited & Extended Care Planning Center Top Reads from Q2 2022

By NAIFA on 7/26/22 3:15 PM

NAIFA's Limited & Extended Care Planning Center is focused on bringing you comprehensive information to help your business thrive in the long-term care sector. Below are the most read and most relevant articles by professionals like you from this last quarter (April to June 2022), written by NAIFA and our dedicated partners.

Want to see more of this content, or have a suggestion of topics you would like to see discussed? Let us know at lecp@naifa.org.

Annuities and LTC Insurance: Two Case Studies in Planning

By NAIFA

Annuities can be an important part of long-term care planning, Tom Riekse, ChFC, CLU, CEBS, Managing Director at LTCi Partners, told attendees of NAIFA’s Limited and Extended Care Planning Center webinar. “Unfortunately, there has probably not been as much emphasis on how they can work together in a plan for care as there should be based on some of the great benefits available.”

Topics: Long-Term Care Life Insurance & Annuities Reverse Mortgages Limited & Extended Care Planning Center

1 min read

LIMRA Finds Employers Look to Modify Employee Benefits Offerings

By NAIFA on 7/14/22 8:55 AM

A new survey by NAIFA’s industry partner LIMRA and EY found that about 75% of employers believe they will need to modify their employee benefits packages within the next five years to attract and retain top talent. Among the top benefits employers believe workers will be most interested in are: life insurance, paid family and medical leave, short-term disability, long-term disability, and physical wellness programs. The survey also found that a significant portion of workers place a greater value on workplace insurance benefits – particularly health insurance, life insurance, and disability insurance – than they did prior to the COVID-19 pandemic.

Topics: Group & Employee Benefits LIMRA Limited & Extended Care Planning Center

4 min read

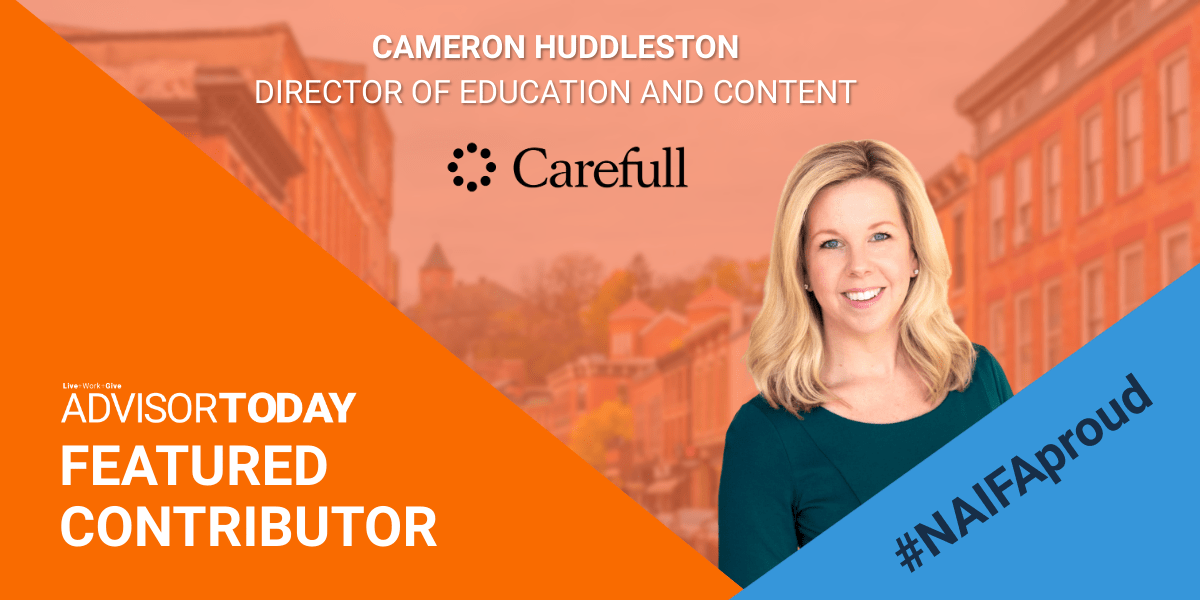

How to Use Trusted Contacts to Gain New Clients

By Cameron Huddleston on 7/8/22 4:59 PM

Do you ask your clients for trusted contacts?

Since 2018, brokerage firms have been required by FINRA Rule 4512 to ask their retail customers to provide the name and contact information of a trusted contact person. Although the rule applies only to broker-dealers, it’s still a best practice for all wealth management and financial advisory firms to gather this information from clients.

Unfortunately, time-strapped advisors too often treat getting trusted contacts as an administrative task versus an opportunity to grow their practice. Trusted contact record-keeping should be thought of as a critical practice infrastructure, contributing far more than a list of emergency numbers. If you’re not already asking clients for trusted contacts, here are two key reasons why you should.

Reason 1: Protect aging clients from fraud and exploitation

As an advisor, you help clients build sound financial plans. However, all of that planning can be for nothing if your clients lose their money to elder financial exploitation. Millions of older Americans become victims of scams or financial abuse each year and lose more than $3 billion annually to these crimes, according to the FBI.

The aim of FINRA Rule 4512 is to protect investors—particularly seniors—from fraud and exploitation. Firms can reach out to their customers’ trusted contacts if they are concerned about activity in customers’ accounts.

Advisors are the first line of defense for older adult clients. By creating your own trusted contacts policy, you can get authorization from clients to reach out to someone they trust if you suspect your clients’ assets are at risk of exploitation. A trusted contact can help you confirm suspicions that a client’s financial decision-making ability has been impacted by cognitive decline issues or that a client is being taken advantage of by scammers or even family members. In short, it’s the right thing to do to provide your clients with the protection they deserve.

Topics: Prospecting Limited & Extended Care Planning Center

How Not To Tear Your Family Apart: Things That Bring Joy

By Carroll Golden on 6/17/22 9:30 AM

Life can be unpredictable and challenges will arise. We cannot always control our circumstances, but we can control our perspective and what we focus on. Choosing to see the good in bad or hard situations is what will make the ultimate difference in the long run. The CPT (Care Planning Team), is an important resource regarding this. They help individuals get back on track in their lives and continue that joy perspective.

Topics: Limited & Extended Care Planning Center

How Not To Tear Your Family Apart: What Can You Grow?

By Carroll Golden on 6/16/22 9:30 AM

Long-term growth requires long-term planning. Reduction in taxes, fewer fees, more savings, and exponential growth, are all factors of long-term planning. A long-term care funding plan was also created which increases success in these areas and is an option for those wanting to be smarter with their finances.

-CMYK.png?width=200&name=LifeSecureLogo(F)-CMYK.png)

%20.png?width=148&height=55&name=b.%20RSSA_Logo_(R)%20.png)