Long-term growth requires long-term planning. Reduction in taxes, fewer fees, more savings, and exponential growth, are all factors of long-term planning. A long-term care funding plan was also created which increases success in these areas and is an option for those wanting to be smarter with their finances.

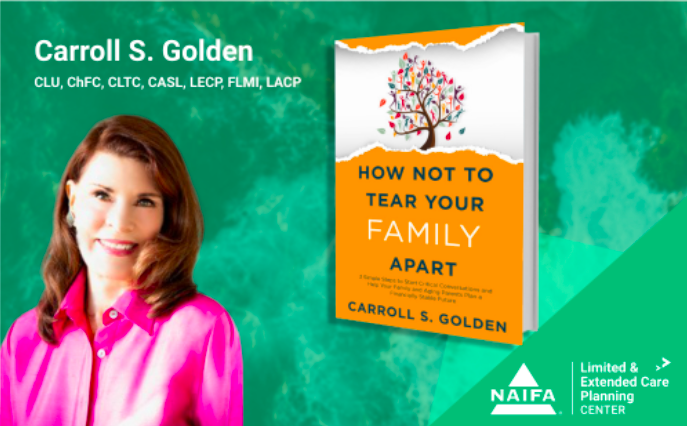

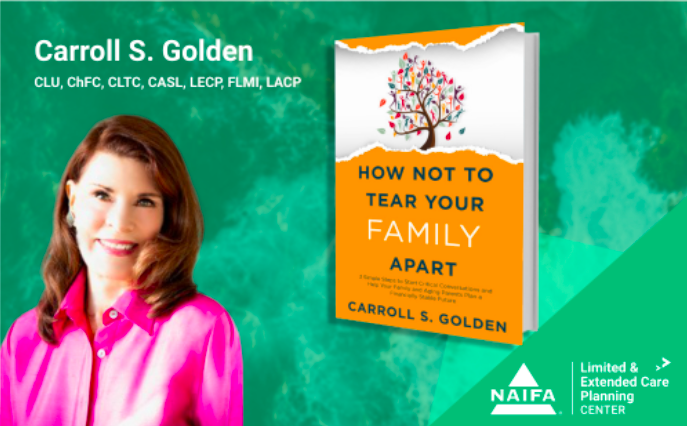

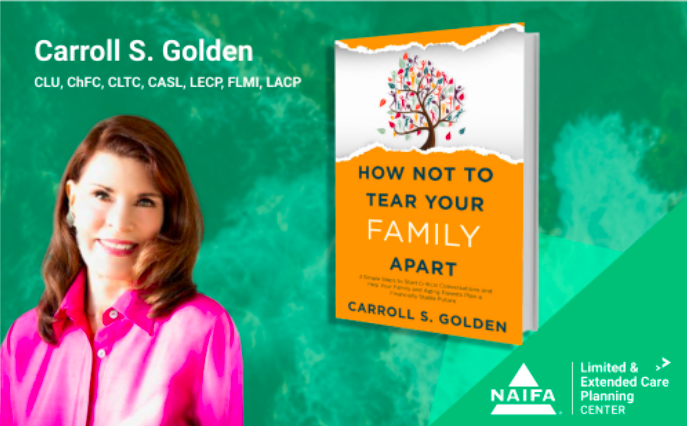

How Not To Tear Your Family Apart: What Can You Grow?

By Carroll Golden on 6/16/22 9:30 AM

Topics: Limited & Extended Care Planning Center

How Not To Tear Your Family Apart: Cash Flow Concerns

By Carroll Golden on 6/14/22 9:30 AM

Proper preparation = better cash flow. Without thorough forethought and intention put into place for the future, cash flow is bound to be a concern. This excerpt dives into the specifics of what a lack of preparation results in and the cash flow measures that should be taken to prevent them.

Topics: Limited & Extended Care Planning Center

How Not To Tear Your Family Apart: Caregiving Impacts Retirement

By Carroll Golden on 6/13/22 9:30 AM

One of the most overlooked threats to retirement is when people need to either limit their earning potential in the workforce due to caregiving demands (think not taking a promotion or limiting the ability to travel), or they leave the labor force altogether because the demands of caregiving are so great. This excerpt explores the impact that leaving/diminished workforce engagement has on future retirement planning.

Topics: Limited & Extended Care Planning Center

1 min read

Loyal NAIFA Member Cheryl Canzanella Joins Fairway Independent Mortgage

By NAIFA on 5/26/22 10:28 AM

We're pleased to congratulate loyal NAIFA member Cheryl Canzanella, CLU, ChSNC, LUTCF, on her new position with NAIFA partner Fairway Independent Mortgage. Cheryl will take over the role of HECM Business Development Manager - Retirement Solutions.

Since joining NAIFA in 2010, Cheryl has been active in the NAIFA community. She is a Past President of NAIFA-Northeast Florida and has served in leadership positions at the local, state, and national levels. She is also a recipient of NAIFA-FL's President’s award. In 2019, she was recognized as NAIFA’s Young Advisor Team Leader of the Year. Cheryl is also a Founding Past President of Women in Insurance & Financial Services (WIFS) Northeast Florida.

Topics: #NAIFAProud Leaders

How Not To Tear Your Family Apart: 20 Years from Now

By Carroll Golden on 5/3/22 1:37 PM

"A lack of planning has immediate consequences and possibly consequences that will reach 20 years into the future," says Golden in her new book, "How Not to Tear Your Family Apart". Golden has been bringing the concept to both financial advisors and consumers that we need to get the conversation started far sooner than anyone expects so that dire consequences do not occur that possibly impacts generations to come.

Topics: Limited & Extended Care Planning Center

1 min read

Webinar On-Demand: IUL Sales Ideas and Long-Term Care

By NAIFA on 4/8/22 12:42 PM

Increased awareness of long-term care (LTC) insurance means increased interest in LTC coverage. However, not all clients qualify for a traditional LTC rider.

Topics: Long-Term Care Life Insurance & Annuities Limited Care Potential Partners for Advisors Insurance

4 min read

How to Protect Aging Clients from Financial Exploitation

By Cameron Huddleston, Carefull Family Finance Expert on 3/31/22 10:00 AM

Financial exploitation of older adults is rampant, and the problem will only get worse as America’s population continues to age.

In fact, the rate at which adults over the age of 60 can expect to experience financial exploitation—1 in 20—is higher than the incidence of many age-related diseases, according to research published in The Journals of Gerontology. And that’s likely an underestimate because many older adults are unwilling to report exploitation.

Topics: Long-Term Care Extended Care Limited Care Potential Partners for Advisors

1 min read

Webinar On-Demand: LTC Pricing in Uncertain Times

By NAIFA on 3/30/22 10:27 AM

Rising interest rates and inflation can dramatically impact long-term care insurance pricing.

This month, LTCI Partners Managing Director Tom Riekse spoke with Robert Eaton, Principal and Consulting Actuary of Milliman. In addition to interest rates and inflation, Riekse and Eaton discussed recent innovations in LTC product design and how to build trust in the digital age.

Topics: Extended Care Limited Care Long-Term Care Insurance

2 min read

Sen. Scott Promotes Care Planning and LTC Insurance in Committee Hearing

By NAIFA on 3/25/22 2:43 PM

Senator Tim Scott (R-SC) knows the importance of the insurance and financial services industry and the role of agents and advisors in the wellbeing of Main Street Americans. He gained much of this understanding in his pre-political career as an insurance professional and NAIFA member.

Topics: Long-Term Care Limited & Extended Care Planning Center Federal Advocacy

5 min read

Why Your Clients Should Plan for Long-term Care Sooner Rather than Later

By Fairway Independent Mortgage Corp. on 3/23/22 4:41 PM

There is and likely will always be a debate between what’s better: “optimistic” or “realistic” thinking. When it comes to retirement and aging, it’s beneficial to have both mindsets. To look forward to the enjoyment of the golden years while recognizing the need to plan ahead for rainy days.

-CMYK.png?width=200&name=LifeSecureLogo(F)-CMYK.png)

%20.png?width=148&height=55&name=b.%20RSSA_Logo_(R)%20.png)